Bundle and Save on Home Insurance in Edmonton!

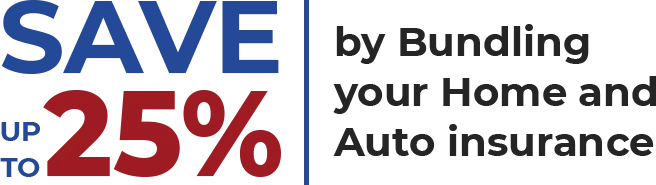

When you bundle your home and auto insurance policies in Edmonton with Leibel Insurance, adhering to your home policy coverage, you could enjoy significant savings of up to 25%.

Call (866) 484-8880 now to speak directly with an Insurance Expert about Edmonton Home Insurance coverage or complete a no-pressure no-obligation quote request form below.

COMPARE & SAVE

Let Us Do The Work for You. Get Your Quotes From Our Top-rated Insurance Brokerage.

How to Lower Your Home Insurance Premiums in Edmonton

Here are some specific ways to potentially reduce home insurance costs in Edmonton:

Bundle Policies

Learn More

Choose a

Higher Deductible

Learn More

Take Advantage

of Discounts

Learn More

Edmonton’s Best Home Insurance Broker

Contact Leibel today for a home insurance quote in Edmonton as well as other cities in Alberta and Ontario, find out the FREE quote request form, or call office today.

Types of Edmonton Home Insurance Policies

We care about our clients and will take the time to create long-term relationships, ensuring the contents of their home policy always meets their needs with the right coverage. We will provide you with all the details you need and will start with the three main types of home insurance plans you can consider.

Basic Home Insurance

Broad Home Insurance

Safeguard your Edmonton home against all typical risks, while ensuring that only the risks specified in your policy are covered for your contents.

Comprehensive Home Insurance

What Does Home Insurance Cover in Edmonton?

Damage to Your Home

Your home insurance coverage protects your home’s physical structure and additional structures such as garages and sheds. It will protect your structure from risks such as fire, lightning, or other risks that are covered in your home insurance policy.

Loss of Personal Items

The physical replacement costs for your personal belongings will be covered if they are damaged or stolen during a break-in.

Legal Liability

This coverage protects you for any undue property damage or personal injury guests are accidentally subject to.

Additional Living Expenses

Your policy will cover you for additional living expenses if your home is severely damaged, and you are unable to live in it while repairs are being made.

Our Simple Insurance Quote Process

Here’s a simplified three-step process for obtaining a home insurance quote through Leibel Insurance.

Contact and Initial Consultation

- Contact us by phone or submit a request using our “Get a Quote” form to set up an appointment.

- Discuss your Edmonton home insurance needs and preferences with one of our agents, including desired coverage options and any specific requirements.

Quote Comparison and Presentation

- We gather home insurance quotes from our list of approved insurers.

- We will compare the coverage options, deductibles, and premiums offered by each insurer and present you with the best available options based on your needs and budget.

Policy Selection and Finalization

- Review the home insurance quotes provided by Leibel and select the policy that best meets your requirements.

- Complete the application process with our assistance, providing any necessary documentation.

- Once the policy is approved and issued by your chosen insurance company, arrange for payment of the premium and receive proof of insurance.

Coverages for Different Home Types

Our Local Home Insurance Quotes

ALBERTA

Bonnyville

Edmonton

Calgary

Okotoks

Cold Lake

Westlock

COMPARE & SAVE

Let Us Do The Work for You. Get Your Quotes From Our Top-rated Insurance Brokerage.